In 2018 a conversation I was having with an acquaintance of mine in London turned to the topic of money. Thinking he’d be interested, I remember telling him that starting in 2019 we were going to witness a revolution in our money and financial systems. “A revolution?” he said. “How so?”

Although I didn’t know how every final detail would play out, I was pretty sure these fledging cryptocurrencies were going to become a massive part of our lives. Money was going to move away from banks and government control and become de-centralised. He looked sceptical. Cryptocurrencies were just a stupid craze. Why did I think otherwise?

Because, I said, of an imminent change in the skies. A planet was shifting signs. And at that moment, I lost him.

But fast forward to today and it is clear that what I (and to be fair many other astrologers) foresaw is coming to pass. We are now in the middle of a monetary revolution. For those not remotely interested in stocks or gold or financial stuff this might not seem to be important to your life. But believe me: the revolution taking place in Silicon Valley and Wall Street and China will soon impact everybody to varying degrees. I shall shortly explain why.

But first the astrology: in March 2019, the planet Uranus entered the constellation of Taurus. Taurus is the constellation of money, food and beauty. Uranus is a lightning bolt. Uranus travelling through Taurus = a massive shake up in global financial systems (not to mention food production and the beauty industry). By the time Uranus leaves Taurus in late 2025, the monetary revolution it has started will be unstoppable.

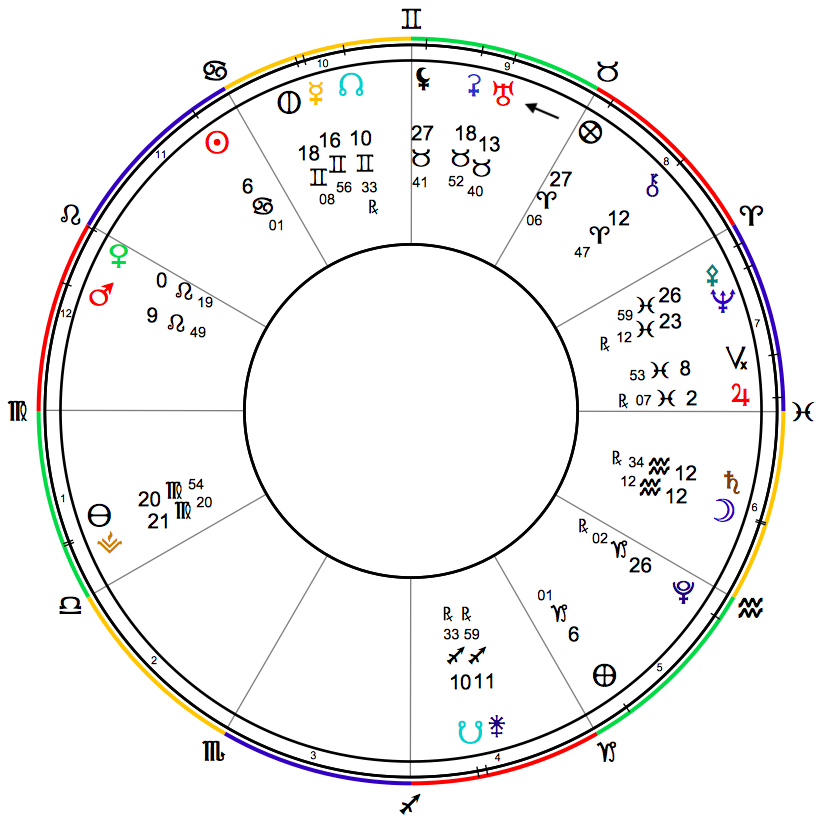

The Chart of the Moment. At time of writing, 26 June 2021, Uranus is at 13 degrees in Taurus (pointed out by the arrow).

So what does this revolution look like?

Bitcoin (BTC) has (almost) gone mainstream.

BTC is the most exciting thing going on in the world right now. More and more people are getting their heads around it. Of all the important details about this invention, perhaps the most important is that there is a limited supply. There will only ever be 21 million of them. Anything with a finite supply makes a good asset. Particularly in these times.

Over time, nations overstretch themselves and spend more than they produce. To “get away with it” Government central banks print money out of thin air. This leads to inflation, a growing wealth gap and finally a decline in living standards for nearly everyone. We in the West are witnessing inflationary monetary policies that will not end well.

The Millennials, born when Uranus was in Aquarius (1996-2003) and staring down the barrel at the inflation and the huge debts they will be inheriting, instinctively grasp that BTC is an asset they can be a part of which cannot easily be devalued or manipulated. Even if Bitcoin is superseded by another digital asset, the idea of de-centralised assets and de-centralised money is now part of the zeitgeist.

Most people look at the current value of a BTC in US Dollars. But flip the chart around and you see something more startling: the depreciation of the USD against BTC. The trajectory of the line tells you everything – since 2009 the Dollar has been steadily and inexorably losing value against BTC. Ditto for the Euro and the Pound.

The Blockchain

The blockchain (the technology Bitcoin rests on) is an accounting system we can finally trust, which is not owned by any country and accessible to all. But don’t get hung up on the accounting part; focus on the decentralised aspect of this technology.

Why is this important? Well for now our lives are funnelled through centralised systems. We search for news, knowledge and items on Youtube, Facebook, Amazon, Twitter and Google. These platforms are all controlled by Billionaire owners with their own agendas. The increasing censorship on these platforms shows how too much centralised power always corrupts. The blockchain will allow the free flow of not just goods and services but ideas. Without freedom of thought, democracies die.

Central Bank Digital Currencies

You might think we already have digital money. To some extent we do. But most societies still also use paper money. That will change. Central Banks want to remove the existence of cash and make all transactions visible on a blockchain.

On the plus side, Digital Currencies will reduce tax evasion and should eliminate counterfeiting.

However, Digital Currency is fully programmable money. This will give governments far more power over our spending habits than they have currently. If this is rolled out high street (savings) banks and commercial banks will disappear.

Digital currency will be a particular risk for those living under totalitarian regimes! If those governments want to stimulate the economy, they will be able to put an expiry date around money or savings – “spend it by X Date or lose it”. It will also be much easier for them to turn off the financial taps for “dissidents”. And Digital currencies do nothing to prevent governments from continuing to create money out of thin air.

You may have already started to hear talk about a possible US “FedCoin” on the horizon or a UK “Britcoin” or a Chinese “Digital Yuan”. It is coming. We in the West will have to be especially vigilant to make sure our law makers protect us from excessive governmental intrusion into how we spend and save.

The Fed is not at the stage of “a broad discussion” about a Fedcoin or Digital Dollar – it is already far further down the line in its plans for rolling it out. As ever, the media is being used to drip feed the idea to the masses to prepare us – and gauge our reaction.

Other Cryptocurrencies and “Digital Wallets”

Bitcoin is more an asset than a currency. But there are thousands of other cryptocurrencies in existence like Ethereum and Litecoin and while most will probably fail, some of them may well take on the status of de facto second currencies. The digital wallet of the near future will hold our national currency, our Bitcoin and other cryptos which might be needed to make specialised purchases like financial contracts, digital artwork etc.

Decentralised Finance

The revolution of 2020 was the rise of “DeFi”. The idea here is that anyone can privatise their assets and trade them without having to do it through a third party like a broker. The classic example is Non Fungible Tokens – people uploading artwork pieces that can only be viewed by the purchaser.

So there you go. The revolution is coming, and fast.

And I don’t even have the space to talk about this: El Salvador becoming the first country to adopt Bitcoin as legal tender.

Is Uranus in Taurus Good or Bad?

In the short term in the West (and weaker economies) some of these changes are clearly going to cause some turbulence: the declining purchasing power of the Dollar or the Pound for example will be worrying for most households. We will be faced with increased dilemmas about how to best stay secure.

Government digital currencies have the potential to be very 1984 if we as citizens are not vigilant.

But in the longer term, Uranus is hopefully working to make changes that get us out of the impending financial trap most of the world has got into. Our old ideas are not working – we need to change! Uranus is here to assist.

By late 2025, Uranus’ job in Taurus is done. Then it moves into Gemini, staying there until 2033. In that time frame expect all hell to break loose with the way we communicate and interact with each other! (Gemini rules communication). Virtual reality and Star Wars style holograms will be an everyday part of our lives. And I would not be surprised if a laboratory somewhere in the US or China announces that they have successfully completed their first tests of….teleportation.

But that is a whole other story!